-By Jayasri Priyalal

(Lanka-e-News -13.Aug.2023, 2.00 PM) The policymakers both in developed and developing countries are keen in promoting resource distributive policies, anticipating growth in the economies take effect automatically. Such dysfunctional growth policies are expected to unleash dire unintended consequences in the long run. The trend leads borrowing from the future, as the benchmark set of solutions proposed, to stimulate sagging economies across the globe, even in the pre and post COVID-19 pandemic. It appears that policymakers are utterly confused between extraction of resources for distributive purposes.

Debterioration is the word the writer coined in May 2019, cautioning the impact of the unconventional monetary policies introduced in the name of quantitative easing (QE) by the Federal Reserve Bank in the USA and the European Central Bank. The background analysis for the essay was based on the facts prior to the onset of COVID-19 pandemic. https://asiancenturyinstitute.com/economy/1513-the-great-debterioration

Now it reveals that the quantities of money so released with QE, works out to around US$ 30 trillion. The excessive volume of money that was cloned, not added as surplus outcomes of production and services in the real economy. Unorthodox public private partnership engineered to ease the tensions to avoid bankruptcies of rich and famous at the expense of taxpayers. The current inflationary trends are direct impact of the artificial money in circulation. The resultant outcome now turns out to be a net Qualitative Extraction from the future prosperities of the marginalized.

History reveals, that pandemics in the past have been turning points in human civilization. The Black Death, in the thirteenth century ended the serfdom in Europe and gave the way for payment of wage for labour as there was a huge shortage as the pandemic wiped out half of the population in Europe. Similarly, the HINI influence popularly known as Spanish Flu in the early twentieth century set up the benchmark for eight hours of work. As many workers had to rest from work to recover from the influenza. The first convention of the International Labour Organization (ILO) recommends eight hours as dignified period of work for humans per a workday. ILO is the first UN agency which was formed as a tripartite institution in 1919 after the WW1. These incidents have shaped the progress of civilization of the mankind stimulating real economic growth for common prosperity not limiting it to a few.

This writer very well recalls the treasury bond saga under the Yahapalana government in 2017. How then the bond-master, veteran investment banker Governor of Central Bank of Sri Lanka Arjuna Mahendran introduced the long-term bonds with a maturity tenure of 30 years. Moreover, tripling the volume of the bonds offered in the weekly auction by CBSL, in the history of the Government Debt department. It is an irony; such short-sighted decisions were possible under then Prime Minister Mr. Ranil Wickremasinghe who was incharge of Central Bank affairs, is now overseeing the Domestic Debt Restructuring following the near bankruptcy of the economy. Sri Lankan’s are destined to realize that the chosen healer itself the disease leading to another debt pandemic to resurface in time to come.

Domestic Debt Restructuring. Extending the maturity of the guilt edged risk free government debt instruments, for how long? Truly, are they free of risks? Shortermism ended in Debterioation of the economy of Sri Lanka. The trend is everywhere across the globe, fake prosperities feeling of richness, thanks to the impotent capital circulated as debt is certainly implodes the current debt ridden unsustainable financial architecture. Will this be another turning point, following the COVID 19 pandemic? Major central banks such as in China, India and Sweden are now testing grounds for introduction of Central Bank Digital Currencies. De-dollarization of the international payment and settlement system is also in the pipeline.

Sri Lanka is a nation, where we are good at finding problems in solutions, instead of finding appropriate solutions for problems. Keeping up with tradition, a parliamentary selet committee has been appointed to find out the causes that led to the virtual bankruptcy of the economy. When the bond-saga came into light then Prime Minister appointed a committee of three legal experts to investigate the allegations against Governor Arjuan Mahendran, and the committee exonerated him. A full drama of the crime came into light during the committee of inquiry commissioned by the President Maithripala Sirisena. No one has still been held accountable or responsible for the crime, but many gained perpetually creating a pain on the entire population. A good analogy to describe the drama is to recall popular Sinhala saying, which interprets as - consulting robbers mother in a soothsaying attempt in search of clues of the robbery.

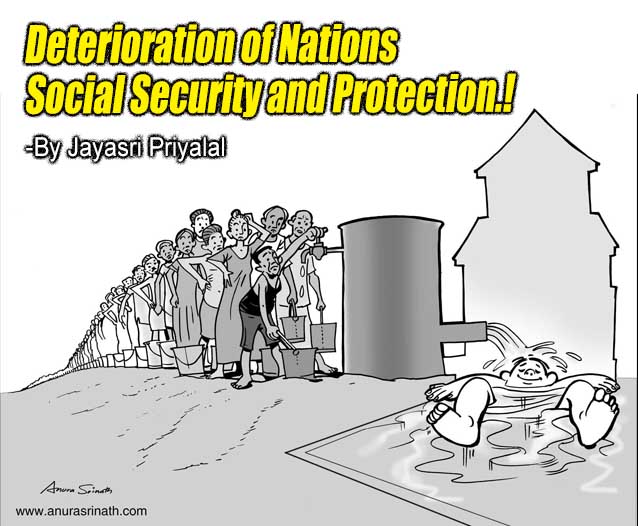

A classic example how those who are in power throws life-boats to high net worth friends and cronies for their rescue and survival, and take away the life saving jackets from the struggling ordinary citizens for survival, pushing them for perpetual life and death struggle. The proposed Domestic Debt Restruction (DDR) is exactly the same process in taking away the life saving life-jackets from the majority of the working population who had immensely contributed to the growth in to the real economy during their productive life span. And the policymakers are in a hurry to throw life boats to save those financiers engineered the state capture, with the connivence with corrupt politicians. The life boats are also gifted to those extracted profits in financing unsustainable debt particularly in investing in government debt. Many of them go scot free and policy makers are passing the burden on the EPF Social Security fund, largest funds amounting to LKR 2.8 trillions with conditional schock doctrines. Such as imposing of 30% tax, as a form of extraction on the earnings due to the contributors who saved money for their future a secured retired life in coping with demographic and ageing challanges.

Robust social protection and security system has to be put in place enabling the working poor to live and die in dignity. Although Sri Lanka boast of a universal health care systems, as things reported in media, current health care system is in peril as the government is unable to finance the health care needs, also to retain the healthcare professionals in the country. According to the forecast of Institute for Health Metrics Evaluation (IHME) the life expectancy at birth of a Sri Lankan Male in 1990 was 65.6 years will increase upto 81.3 in 2100, and for Females from 74.8 years to 87.2 years.(Forecasted data based on Global Burden of Disease 2017 results). https://www.healthdata.org/sri-lanka

The healthdata analysis in the IHME database reveals in 2019 health care expenditure per person in Sri Lanka amounts to US$ 154, (average per capita) out of which Government Health spending only amounts to US$ 70.34 out of pocket expenditure of the patient amounts to US$ 70.96. Balance paid by development assistance received from donor agencies. This is the plight of the Universal Health Care that was in opertion in the pre-pandemic era. In Sri Lanka we had the benefit of the public healthcare system as a form of social security, tax payers footing the funding since our independence. IHME data reveals how the burden of disease is gradually being passed on to the patient cutting down on the government health expenditure. And the question remains whether the amounts so spent by the government on the patient is actually eased the financial hardship of the marginalized in their healthcare needs or filled up the pockets of few agents who knows how to take care of the policy makers interest.

The latest forecast of the global ageing population trends reveals that a male reaching 65 years in 2020 is expected to live for another 19 years, and a female will live for another 22 years. This trend is possible due to advance of the medical sciences and healthcare facilities. Now the question remains, whether Sri Lankan public health system is geared to meet the healthcare needs of the widening ageing population in the future?

Progressive socially conscious politicians such as T.B.Illangarathne, C P de Silva and Philip Gunewardena under the leadership of Prime Minister S W R D Bandaraniake’s MEP government introduced the Employees Provident Fund (EPF) in 1958 as a form of social security system sharing the contributions between the employers and employees. Furthermore, the systems was further upscaled with the introduction of Employees Trust Fund in 1980 by the UNP government under the leadership of President J R Jayawardena with the wise counsell of Minister Lalith Athulathmudali. All these funds were created to secure the retired life of those contribute to nation building during their primetime in life. Contributions to ETF comes exclusively from employers.

What is happening now, is unfortunate those who manage the fund have deviated from the primary objectives and using the fund just as a slash fund, and trying to impose taxes on the benefits occurring to the members to finance the government expenditure, in particular to service the debts raised for wasteful investments not earning any revenues in the past.

At the outset, this essay questioned the prudentiality of the policy makers abusing the resources for distributive purposes rather than directing it to generate growth for longterm benefits in the society. Having wasted the opportunities to upgrade the quality of life of those who have contributed to the funds both the Employers and Employees, the large pool of money have been abused by those who were in power.

This writer opines that management of all these funds should be under a Board of Trustees, elected by the subscribing members representing the employers, employees and the government regulatory institutions. As at present the funds are held at Central Bank for safe keeping. The pioneers of creating EPF would have opted to keep the money in Central Bank, as at that time similar debt financing was not the main motive of the government. Now the situations have changed involving numerous stakeholders engaged in the affairs of the funds hunting for opportunities take advantage for short term gains at the expense of the longterm benefit of the members. All most 90% of the investments are held in Government debt securities assuming they are risk free. Now we know that there is nothing as risk free guilt edged investment.

These funds have to be invested in projects that really driving the economic growth and strengthening the social security needs of the agening populations, such as building hospitals to provide affordable healthcare and longterm care needs of the members. As things stand today, the government will not be able to source funds to continue payment of non-contributory pensions to retiring employees. A large pool of employees who are expected to retire may have to work for a long period. Lifelong learning and lifelong working will become the norm the way the technology is infiltrating into production and distribution. Aside from providing healthcare, these funds should be invested in upgrading the skills and competencies of the workforce irrespective of their age, and also to build public housing schemes for the members such as in Singapore.

The system change that many Sri Lankans are aspiring should be built on innovative schemes preventing abuse of workers savings by unaccountable irresponsible policymakers. The trade unions who represent the interest of workers, and the industry chambers, employers federations and councils need to unite and come forward to protect the social security of the community driving investment for sustainable development goals.

There are solid systems in operation in other countries such as Australia. Australian Super is one such fund professionally managed by the Australian Council of Trade Unions and Australian Industry. The New Pension Scheme in India is also started recently and progressing well.

Labour law reforms and debt restructuring are attracting media attentions, and numerous public protests and social discussions are boiling up in Sri Lanka. It will be good that sensible policymakers who secures legitimacy to govern with mandate from peoples power to focus into these areas to strengthen the deterioration of systems started with good intentions due to excessive financiliasation as explained.

(Illustration by Anura Srinath)

---------------------------

by (2023-08-13 08:42:57)

Leave a Reply